April 14, 2023

This week, the Consumer Price Index and the Producer Price Index were released. The results were not bad. Unfortunately, they were not great. They showed there is still more work for the Fed to do before they can think about a Terminal Rate.

The CPI ex-Food and Energy report showed some sectors with easing inflation pressures, but housing increased 8.2% over last year which accounted for 60% of the total increase in all items less food and energy. Housing is a lagging part of the index (Remember late last year we mentioned that it was coming). Other so-called “Super Core” components also remained too high for the Fed’s comfort.

The PPI report showed a greater decline than expected, but buried in the report was the Primary Services component, where the BLS tries to estimate the profit margin for retail business. This indicator has a good relationship with profit margins and corporate markups. This figure showed margins in many goods are still well above pandemic levels. Economists are concerned these sticky profit margins are fueling the much-feared profit-wage spiral.

What’s all of this add up to? A speech from a Fed Governor:

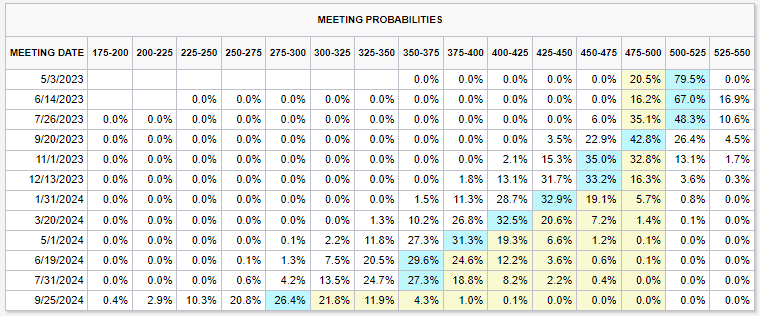

The CME Fed Watch Tool below indicates futures are still pointing to one more 25 basis point increase, but the time frame for potential rate cuts is extending, showing the Fed holding rates high for longer (Just not higher for longer).

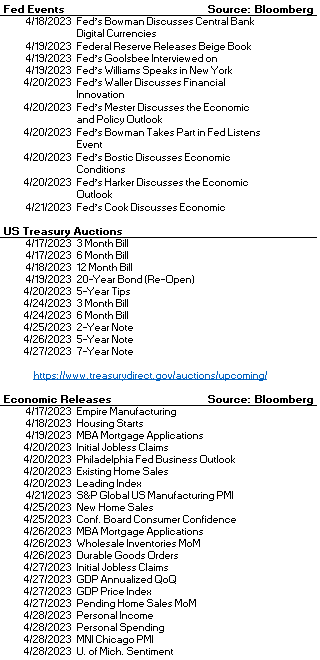

We would encourage investors to carefully look at the yield curve and avoid the lure of high short-term yields. Close inspection of that same CME Fed Watch Tool shows futures forecasting Overnight Fed Funds may decline to 3.75% by June 2024 and potentially going lower after that. Extending some of your portfolio into longer maturities can lock in what seem like low yields today, but could be great yields 1 ½ years from now.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

May 3, 2023

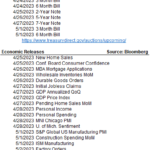

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick