With the possibility of increased taxes on the horizon, the resounding question we receive is, “How should I invest in a high tax environment?”

Municipal bonds are typically a type of tax advantageous investment offering federally tax-free income, and depending on your state of residency, state and local tax-free income. Municipal bonds are bonds issued to fund local projects, such as building a new park, library or even bridges and roads. Adversely to corporate bonds, municipals are backed by taxes and revenues, giving them a historically low default rate risk. Thus, they are generally considered to be comparatively lower risk to other types of bonds.

At Genoa Asset Management (Genoa), we strive to take all client needs into consideration when constructing a customized portfolio consisting of individual municipal bonds. Genoa seeks to invest the portfolios with a value-based total return approach, looking for areas in the curve that could present the greatest value for the client and ongoing monitoring to capture appreciation and total return.

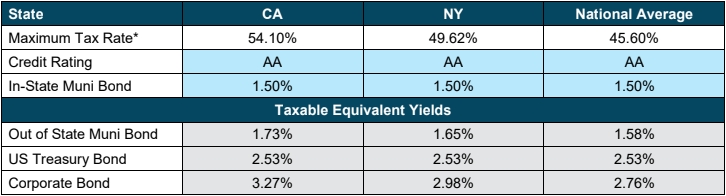

In the below example, in order to achieve a similar yield to a AA rated 1.50% California Municipal Bond, you would need to achieve a yield of 1.73% in out of state municipal bonds, 2.53% in US Treasury bonds, or 3.27% in corporate bonds.

Municipal Bonds vs Other Investment Opportunities

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

508-423-2269

wweese@fmacceleration.com

Rick Bell

VP, Intermediary Sales

513-762-3694

rbell@fmacceleration.com

Curtiss Tharp

AVP, Intermediary Sales

513-762-3660

ctharp@fmacceleration.com

Additional Disclosures

*Federal Tax Rate source: Bankrate

State Tax Rate source: Tax Foundation

This analysis does not consider the federal alternative minimum tax (AMT) or take into account the federal deduction for state and local taxes paid (limited to $10,000 annually) that is available if you itemize deductions.

The calculation of state taxes assumes that your taxable income for state tax purposes equals your federal taxable income. Material variations could cause your state tax rate to be overstated or understated. This analysis ignores the AMT imposed by certain states (CA, CO, CT, IA and MN), the limited deduction for federal income taxes paid that is available in certain states (MO, MT and OR) and the limited itemized deduction for state and local income taxes paid that is available in certain states (AZ, GA, HI, LA, MO and ND). State income tax rates indicated for AL, IA and LA are net of the deduction for federal taxes paid that is available in those states. The 3.8% Net Investment Income (NII) federal tax applies to individuals, estates and trusts with modified adjusted gross income (MAGI) above applicable threshold amounts ($200,000 for single and head of household; $250,000 for married filing jointly). NII generally includes gross income from taxable interest, dividends, annuities, royalties and rents (unless derived from a trade or business that isn’t a passive activity or a trading business) and net gains on assets generating NII, net of allowable expenses. For the purposes of this calculator, your MAGI is assumed to equal your taxable income.

Sources: Moody’s, Bankrate, Tax Foundation

The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any

financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Genoa Asset Management and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Genoa Asset Management cannot guarantee the accuracy of the information received from third parties.

All investing involves risk including loss of principal. Past performance is no guarantee of future results. Bonds are subject to market and interest rate risk if sold prior to maturity. Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Genoa Asset Management. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these types of securities were or will be profitable. There is no assurance that securities discussed in this article have been purchased or remain in the portfolio or that securities sold have not been repurchased. It should not be assumed that any change in investments, discussed in this article have been applied to your account. Please contact your investment adviser to discuss your account in detail.