We believe municipal bonds are still and always will be critical to wealthy investors, but we now feel that the period of municipal outperformance is behind us. We believe that interest rates have stopped going down in general and we are vulnerable to long-term interest rates moving higher in the next few months. We expect that investment-grade municipal total-return performance for the balance of 2021 & into 2022 will be achieved more with the preservation of principal and income versus a longer duration strategy we now employ. The benchmark Bloomberg Barclays 7-year Municipal Bond Index duration is now 4.66 years. We would expect that the duration of new money and the rebalancing of existing client portfolios will be in the range of 4.5 years. New portfolios will be more focused on maturities in the 6-8year range with little to no exposure to maturities less than 4 years until The Federal Reserve Bank starts raising short-term interest rates. Exposure beyond the 6-8year range will be limited to high coupon, callable bonds with a maximum final maturity of less than 15 years. Of course, there will be exceptions to this, but the primary focus will be current income.

Strategically, we will be rebalancing our existing client portfolios taking into consideration:

- Existing cost basis & replacement yield. Many of our existing positions are appropriately structured toweather higher interest rates

- Tax consequences. Limiting capital gains as best we can

- The economic value of swapping positions based on my outlook

The municipal bond market has had an unprecedented run since the depths of the COVID induced liquidity calamity just over a year ago. As a backdrop, in March of 2020 the Bloomberg Barclays General Obligation Bond Index of 10-year AAA yields achieved a 5-year historical low in yield (3/9/20 0.81%) AND a 5-year high in yield (3/20/20 2.88%). During that period, the bid side of the market was virtually non-existent. Bond funds were desperate to hit any bid they could find to cover the daily deluge of redemptions. To put this into perspective, it was reported that one municipal high yield bond fund received an infusion of $700 million from the parent company to stabilize the fund and cover pending redemptions. Compounding that were municipal bond hedge funds being forced to liquidate positions to cover margin calls along with municipal bond dealers exiting the business.

The F/m Genoa Intermediate Municipal Bond Strategy was fortunate to have weathered the storm successfully. The decision not to panic-sell into the maelstrom, despite the pressure, proved to be best for our client portfolios. My having experienced this before was helpful (2008, 1994, 1987). Secondary to that was being one of the few bidders in the lowest points of the market last year buying municipal bonds in as many taxable portfolios as there was cash to invest. Composite performance for the year was modestly better than the index but considering the events of the past year, I consider this a success.

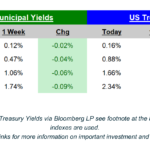

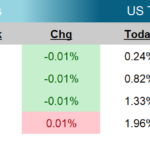

We’ve now come full circle in the municipal bond market. In the past 9 months, 10-year US Treasury yields have risen 114 basis points, while 10-year AAA municipal yields have risen by just 34 basis points. The 7-year Municipal Bond Index has outperformed the Bloomberg Barclays US Aggregate Bond Index over the same period by 429 basis points (7-yr Muni +1.06% vs US AGGR -3.23%). Municipals have outperformed over this period for two reasons. First of all, municipals were still undervalued when the US Treasury market hit the lows in August of last year. Secondly, demand for municipal bonds from wealthy investors has gone unabated for over a year. The high credit quality of investment grade municipals along with the Biden administration’s talk of higher marginal tax rates has contributed to the relative outperformance. Additionally, we have now liquidated virtually all of the municipals in our taxable portfolios realizing the relative outperformance.

Justin (Jud) Hennessy

Director, Portfolio Management

Genoa Asset Management

Disclosures

F/m Investments, LLC, doing business as Genoa Asset Management (“Genoa”), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name.

The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation, or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. This material is not intended to replace the advice of a qualified tax advisor, attorney, or accountant. Consultation with the appropriate professional should be done before any financial commitments regarding the issues related to the situation are made.

The opinions expressed herein are those of Genoa and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. This communication does not intend to be a complete overview of the topic stated, nor is it meant to be a comprehensive discussion or analysis of the strategies discussed.

All investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Municipal bonds are subject to availability, price, and to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rate rise. Interest income may be subject to the alternative minimum tax. Interest may be federally tax-free but other state and local taxes may apply.

Past performance is no guarantee of future results. The performance described does not reflect the deduction of investment management fees; the client’s return will be reduced by the management fees and any other expenses incurred in the management of its account. Statistics are as of the date referenced above and are subject to change. The actual portfolio holdings and investment rates will differ from what is depicted and are subject to current supply, availability, and other market conditions. Additional information on the composites for the strategies described, including performance data, is available upon request. As an investor, you may experience a loss, and your performance may differ from the performance being presented.

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Genoa. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these types of securities were or will be profitable. There is no assurance that securities discussed in this article have been purchased or remain in the portfolio or that securities sold have not been repurchased. It should not be assumed that any change in investments, discussed in this article have been applied to your account. Please contact your investment adviser to discuss your account in detail. This information does not constitute a solicitation nor an offer to buy or sell any securities.

F/m Genoa Intermediate Bond Strategy (inception January 2003) is an actively managed municipal bond strategy investing in mostly high grade, tax-free municipal bond investments. Primary investment strategies include active trading along the yield curve “rolling the curve” and/or a Barbell approach to manage portfolio duration, total returns, and risk. The composite strategy seeks to outperform the Barclay’s 7 Year Municipal Bond Index over time, with investment policy process (IPP) accounts performance benchmarked by IPP characteristics.

The reported benchmark is not intended as a direct comparison to the performance of the portfolio, and the holdings in the strategy may differ significantly from the securities in the index. Index performance used throughout is intended to illustrate historical market trends and performance. Indexes are unmanaged and do not incur investment management fees. An investor is unable to invest in an index.

The Bloomberg Barclays 7 Year Municipal Bond Index measures the performance of the investment grade, US Dollar-Denominated, tax exempt bond market for those with remaining maturities of six to eight years. The index includes four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. It is a market-value weighted index. The index is unmanaged and not available for direct investment. The benchmark index reflects the reinvestment of dividends and income and no deductions for fees, expenses, or taxes.

The Bloomberg Barclays US Aggregate Bond Index is a broad-based benchmark that measures the investment grade, US dollar- denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate agency MBS, ABS and CMBS (agency and non-agency).

The Bloomberg Barclays General Obligation Bond Index is an index that represents average market-weighted performance of general

obligations securities that have been issued in the last five years with maturities greater than one year.