Fixed Income Market Update

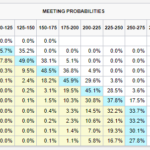

July 1, 2022 We said it, the Treasury Secretary said it, and even the Fed Chair has said it, the Fed is behind inflation and needs to do historic interest rate increases to catch up to inflation. But given the potential of another 75-bps increase, the downturn in some commodities and