December 2, 2022

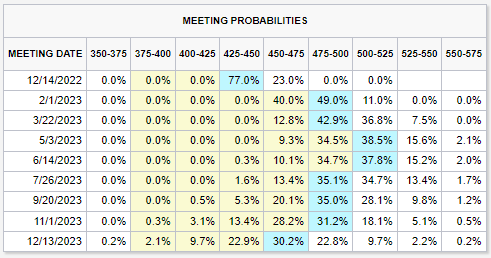

Is the Fed finally Relenting? In a speech at the Brookings Institute, Chairman Powell laid out the Central Banks’ current thinking on the economy, rates and the path forward. In the speech, littered with caveats, the Chairman said what the market expected, and needed. The Fed is thinking of relenting. After 4 record 75 basis point increases to the Overnight Fed Funds rate, a UK Pension-Gilt crisis and the decline of risk assets (Some spectacularly), the Fed is thinking of only raising rates 50 basis points at its December 14th meeting. Did we ever think the markets would be happy for a ½ a percentage point increase in interest rates?

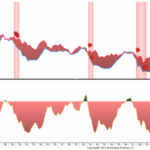

But markets are notoriously short sighted and in celebrating the potential peak of inflation and the light at the end of this interest rate cycle, they are missing a clear sign of the next challenge. On November 8th, something happened that rarely happens, and it has historically been a solid signal of a recession to come, the yield on the 3-month Treasury surpassed the yield on the 10-year Treasury. Also know as an inverted yield curve, right now, you get more yield for lending your money to the government for a shorter time, than you do for a longer time. This counter intuitive situation happens when the markets expect inflation to subside, but short-term rates are still high. Why would inflation subside? Because we are going to have a recession and when we have a recession, demand dries up, jobs are lost, wages stagnate, and prices fall.

What makes this inversion unique is the continuation of Fed rate hikes. Looking back, if the curve inverts, it’s after a rate cycle ends, not before. This Fed, hyper focused on not repeating the mistakes of the 70’s, has stated their intention to raise rates higher and hold the terminal rate for longer. This potentially increases the depth and duration of the recession.

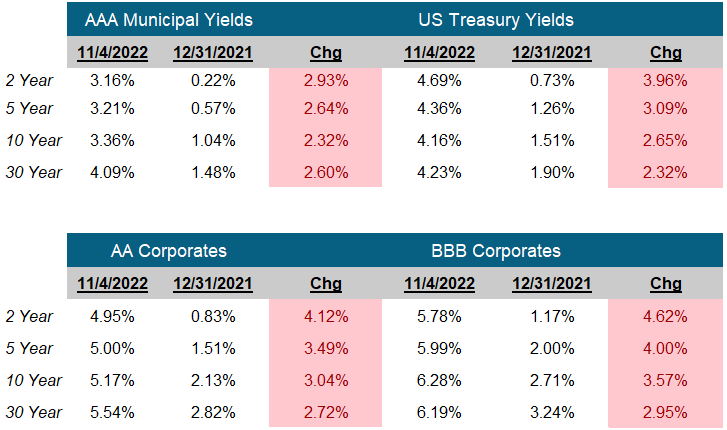

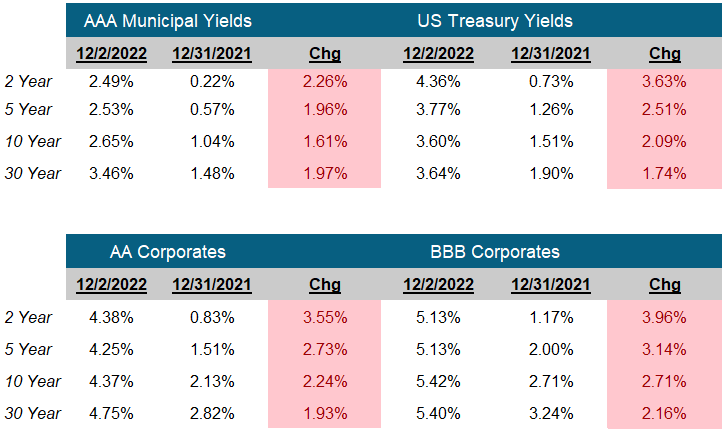

All this adds up to, it’s a great time to be in bonds. While we remain cautious extending into credit, we see opportunities in fixed income without having to take credit risk. Short US Treasury issues have attractive yields and are an excellent place to ride out the coming volatility. We also see good value in longer high-quality tax-free municipals and high grade, liquid corporates where yields are attractive and rates should be stable.

We are using this respite in the markets as a great time to prepare for the coming storms. Repositioning portfolios out of lower quality and less liquid assets, into higher rated, highly liquid assets. This should pay off as the recession clouds gather and liquidity dries up.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Yield Curve Inversion

Generic 10 Year Yield less the Generic 3 Month Yield

Yield Curve Inversion

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Art Blackman

VP, Intermediary Sales

Central

(816) 688-8482

Email Art

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick

Disclosures

Indexes used for AAA Municipal Yields

2 Year: BVAL Municipal AAA Yield Curve (Callable) 2 Year (Symbol: CAAA02YR BVLI)

5 Year: BVAL Municipal AAA Yield Curve (Callable) 5 Year (Symbol: CAAA04YR BVLI)

10 Year: BVAL Municipal AAA Yield Curve (Callable) 10 Year (Symbol: CAAA10YR BVLI)

30 Year: BVAL Municipal AAA Yield Curve (Callable) 30 Year (Symbol: CAAA30YR BVLI)

Indexes used for US Treasury Yields

2 Year: US Generic Govt 2 Year Yield (Symbol: USGG2YR)

5 Year: US Generic Govt 5 Year Yield (Symbol: USGG5YR)

10 Year: US Generic Govt 10 Year Yield (Symbol: USGG10YR)

30 Year: US Generic Govt 30 Year Yield (Symbol: USGG30YR)

F/m Investments, LLC, doing business as Genoa Asset Management (Genoa), is an investment advisor registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. For more information please visit: https://adviserinfo.sec.gov/ and search our firm name. The opinions expressed herein are those of Genoa and may not come to pass. The material is current as of the date of this presentation and is subject to change at any time, based on market and other conditions. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. The information presented does not involve the rendering of personalized financial, legal or tax advice, but is limited to the dissemination of general information for educational purposes. Please consult financial, legal or tax professionals for specific information regarding your individual situation. This information does not constitute a solicitation or an offer to buy or sell any securities. Although taken from reliable sources, Genoa cannot guarantee the accuracy of the information received from third parties. Charts, diagrams, and graphs, by themselves, cannot be used to make investment decisions. Investing involves risk of loss, including loss of principal. Past performance is no guarantee of future results. An index is a portfolio of specific securities, the performance of which is often used as a benchmark in judging the relative performance of certain asset classes. Indexes are unmanaged portfolios and investors cannot invest directly in an index. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown.