July 14, 2023

The recent CPI and PPI reports increased the potential for a soft landing for the US Economy. This is good news, job losses, company defaults and market turmoil should be avoided, if it’s possible. But the FOMC remains steadfast in their determination to fight the inflation they see in readings that are lagging, raising the specter of recession, potentially hard.

June Headline CPI of +3.0% Year-over-year, +0.2% Month-over-month and Ex Food & Energy of +4.8% Year-over-year, +0.2% Month-over-month was a welcome relief for the bond market. Add to that PPI Final Demand of +0.1% Year-over-year, +0.1% Month-over-month and Ex Food & Energy of +2.4% Year-over-year, +0.1% Month-over-month. Those were the best inflation numbers since March 2021.

Sticking a soft landing is very possible at this point. Friday’s employment numbers show overall strength but underlying weakness. Combined with the CPI and PPI report, we can see the opportunity for the Fed to cool inflation and not have the obligatory recession to do it. However, the Fed needs to recognize the lag built into the inflation numbers and not tighten our way into a recession.

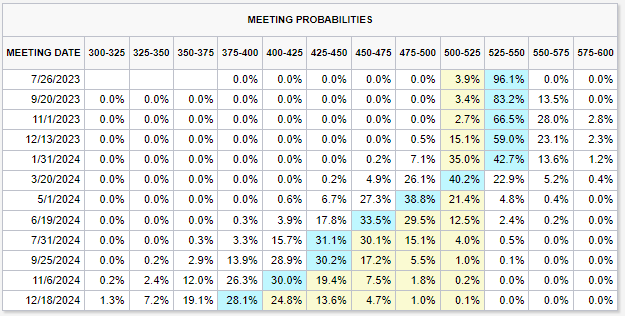

Too High for Too Long could certainly change this equation. A 25-basis point increase is baked into the bond market. Futures expect the 5.25-5.5% rate to stand until the Fed March 2024 meeting. Higher rates have taken more time than usual to work into the economy. When rates were at record lows, most companies refinanced their debt, slowing the effect of rate increases (Some banks missed that page in the play book). Consumers used pandemic payments to reduce debt, again mitigating the constraining effects of debt. So rather than be an immediate impact, rate increases mitigated business expansion and new purchases rather than forcing a contraction in the business or spending. Going forward we expect companies to refinance and consumers to borrow and rate increases to have a greater impact than the first half of the year.

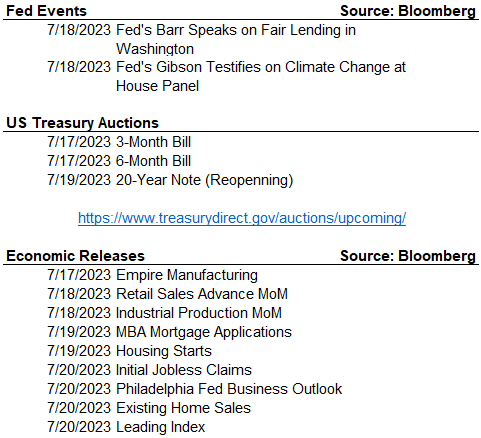

With Friday’s employment report and the inflation reports, the bond market rallied. The 2-Year US Treasury yield fell (Prices rose) from 4.99% on Thursday to 4.76% today. The 10-Year US Treasury also rallied from Thursday’s 4.04% to 3.87% today. It’s sounding like a broken record, but extending portfolio durations should payoff nicely for the rest of this year and perhaps next.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

July 26, 2023

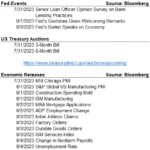

The Week Ahead

CME Fed Watch Tool

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.

Contact Genoa Asset Management

William (Kip) Weese

SVP, Intermediary Sales

Northeast & South West

(508) 423-2269

Email Kip

Rick Bell

VP, Intermediary Sales

North Central & North West

(513) 762-3694

Email Rick