November 3, 2023

Okay, maybe we are early (Maybe we are wrong and rates will never be this low again!) but this has been a powerful rally in the long end of the curve. Since October, the 10-year yield had risen 41 basis points to a high of 4.99% and then, failing to break through 5%, dropped 43 basis points (As of 10:30 AM ET) to 4.54%. The good news supported these moves, from the US Treasury announcing a smaller and a better-balanced issuance calendar, to a seeming Pivot by the Fed Chairman to a weaker than expected jobs report. Bond investors have recognized the value in the 10-year and piled in.

The US Treasury had more receipts than they estimated in July, so they cut the anticipated need for debt in the fourth quarter. After the poor October auctions of the 20 and 30-year US Treasury bonds the market also feared, given the US Treasury had no room to issue more bills, they would increase the issuance of long bonds. Recognizing that concern, the US Treasury increased the issuance of the mid-term part of the curve (3, 5 and 7-Year Notes), balancing investor concerns with the need for funding.

Listening to the Chairman at the post announcement press conference, you might not have heard the pivot, but the market did:

“The question we’re asking is: Should we hike more?” Powell told reporters during a press briefing after the decision. “Slowing down is giving us, I think, a better sense of how much more we need to do, if we need to do more.”

That is a different statement than the market expected, less hawkish. We will see if the parade of Fed speakers over the next few weeks will validate the market’s take on this “Pivot”.

Topping off a strong week was the Jobs report Nonfarm payrolls increased 150,000 last month, less than expected, following a downwardly revised 297,000 advance in September, a Bureau of Labor Statistics report showed Friday. The unemployment rate climbed to 3.9%, and monthly wage growth slowed. All of which added up to a moderating job market. Just what the Fed wants to see to be able to stop raising rates.

So is this the turn? Perhaps, we have been extending duration and buying longer dated bonds through the downturn. It’s a matter of value: a 4.54% 10-Year yield is still 2.54% above a 2% inflation target, very attractive by historical standards. Add to this the risk of lower rates next year and into 2025, we think it is still worthwhile to continue to average into duration through this cycle.

-Peter Baden, CFA

Chief Investment Officer

Click on the above links for more information on important investment and economic concepts.

Next FOMC Decision

December 13, 2023

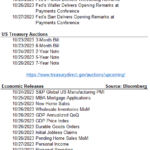

The Week Ahead

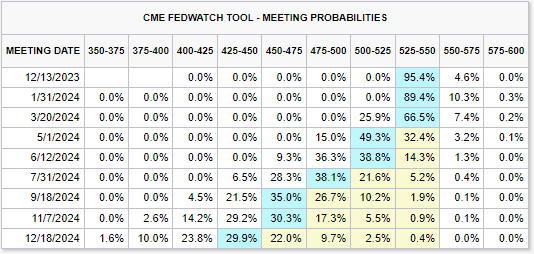

CME Fed Watch Tool

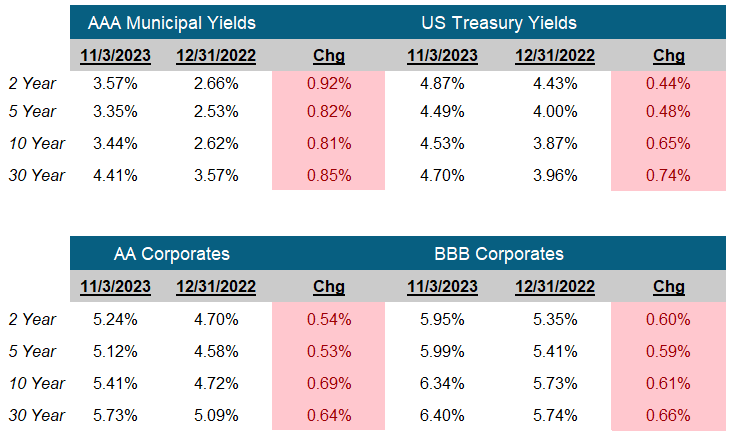

Fixed Income Rates

Click on the above links for more information on important investment and economic concepts.