Objective and Approach

The Genoa Intermediate Municipal Bond Strategy seeks income and total returns through customized portfolios of high-grade, tax-exempt municipal bonds tailored to the specific needs and objectives of the client.

Portfolio Construction

| • +/- 15 bonds per portfolio |

| • AA to A target average rating |

| • BBB minimum rating |

| • +/- 1 year duration versus benchmark |

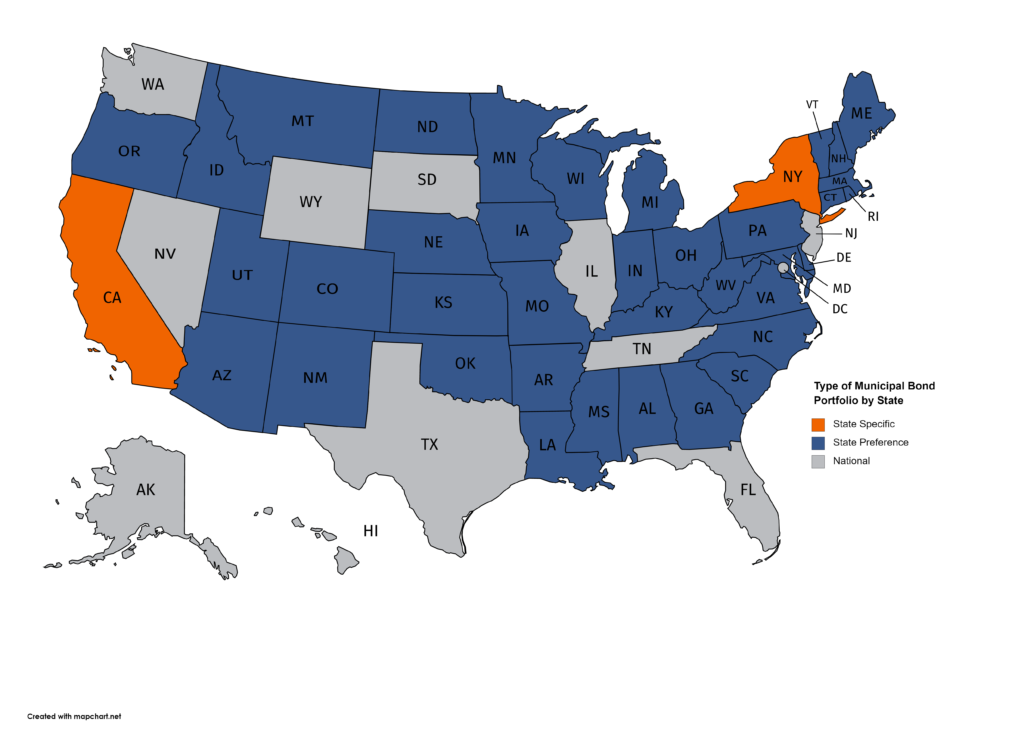

Flexible Allocation

Based on Investor state of residence:

| National | Diversification for clients with no state income tax obligations |

| State Preference | Flexible portfolio of in-state or out-of-state bonds selected for after-tax yields and value characteristics |

| State Specific | Seek to maximize after-tax yields for clients in high tax states such as California and New York |

We strive to enhance our personalized portfolios with diligent fixed income research across markets, sectors, and individual securities.

We seek to further enhance our portfolios through opportunistic trading based on our long experience and our flexibility as a nimble, boutique fixed income manager.