Written by Sarah Conwell, Portfolio Manager

Headlines of the Week

- Here are the highlights from the heated exchange between the U.S. and China in Alaska

- Fed won’t extend relief for banks from key capital rule

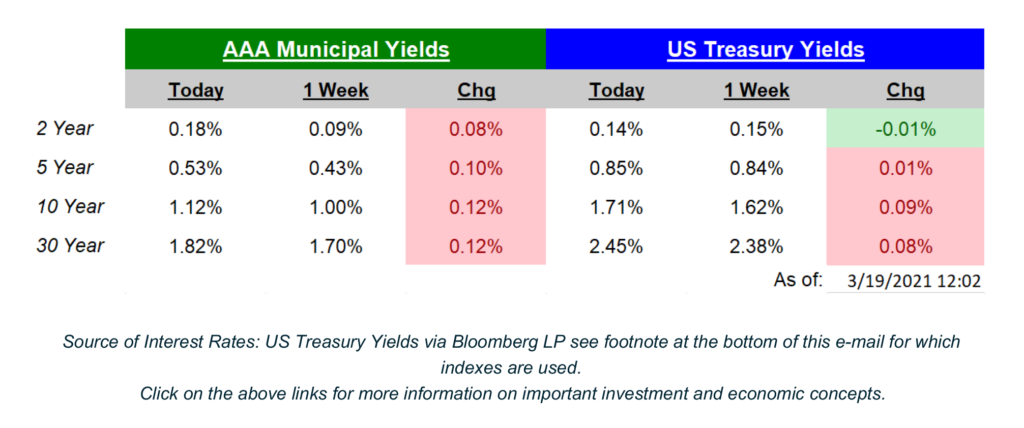

The US Treasury yield curve steepened yet again in the week, as the market grappled with the Fed’s unchanged rhetoric and new policy framework. Specifically, the 10-year Treasury yield increased more than 9 basis points from Tuesday to Thursday on the back of these developments. As of this writing, the yield stands at 1.71% and is the highest since January of last year.

Retail Sales, reported on Tuesday, fell 3% in February, a much larger drop than expected. January’s growth was upwardly revised, however, to 7.6% from 5.3% and was able to somewhat offset this negative print. In addition, this month’s results are likely due to the weather and are therefore temporary; chilly temperatures and loads of snow likely kept shoppers indoors.

The Federal Open Market Committee (FOMC) met on Wednesday to deliver their updated Summary of Economic Projections (SEP) while leaving short-term interest rates unchanged, as expected. As noted in the opening paragraph, Fed Chair Jerome Powell’s nonchalance about the recent uptick in long-term rates left traders in the US and overseas uneasy and the bond market sold off as a result. In the SEP, GDP was revised to 6.5% from 4.2% in 2021, unemployment is now expected to end the year at 4.5% (6.2% currently), and the PCE deflator is forecasted to reach 2.2% this year while retreating a bit to 2.0% in 2022. These updated projections reflect the expectation of a pickup in economic activity following the rollout of the vaccines and consumers resuming their “normal” life in a post-pandemic world, or as close as we can get to that at least. Finally, the Dot Plot noted that 7 of the committee members are expecting at least one rate hike by 2023, up from only 1 at December’s meeting. Importantly though, the majority of the committee members (the remaining 11) do not expect any hikes through 2023. This week’s Chart of the Week is the FOMC Dot Plot from Wednesday’s meeting. Next week, the third estimate of fourth quarter GDP is released alongside Personal Income, Personal Spending, and the Personal Consumption Expenditure (PCE) Deflator.

Click on the above links for more information on important investment and economic concepts.

Chart of the Week